The Islamic & Middle Eastern Market Venture Capital Despite the fact that there are literally millions of Muslim entrepreneurs in both developed and developing countries in search of investment capital for their new start-ups, is the realm of Islamic venture capital in an evolutionary state. However, the untapped potential of Islamic venture capital remains enormous. Moreover, the Islamic world has more than its fair share of investors with high-end net worth looking atInvestment in potentially lucrative deals. To lead the convergence of both a "necessity" and a "delivery" will inevitably mean that the creation of a new product, and it is also so in the case of purely Islamic venture capital.

The core is all planned Islamic finance business that Sharia law prohibits (Islamic law) interest-based lending. In addition, Sharia prohibits further investment in specific activities as a violation of Islam, are seen as gambling at.

However, inBeings, not the mechanics of venture capital for not lending. Rather, the core of a venture capital financing is an agreement to participate in the risks of the enterprise in return for the profits derived from such business venture.

As such, rather than hold it against Islamic law, many scholars, that venture capital funding in line with one of the cornerstone principles of Islam, it provides much-needed investment in start-up companies in exchange forthe potential gains, while accepting the risks that may be involved in such a transaction. This kind of structure in Islamic finance mudaraba is funding, which is used for many centuries in the Islamic world.

Structuring an Islamic Venture Capital Deal

The exact translation of a mudaraba financing is a contract under which a person (the investor known as Rabal-maal), brings together the financing and the other person, the operator (known as the mudarib)brings expertise and effort. Together, they share the profit ratio according to the predetermined arrangement.

Fundamental to the mudaraba financing structure, however, is the fact that the entrepreneur running the risk of being given a financial investment / value. If the business venture fails, the entrepreneur will lose the maximum investment they make in the corporate sector itself (that is, could their own money), and all the time and effort into itVenture. The reason why this is the case because under Islam, one can not lose, not what you contribute.

Moreover, strictly speaking, under a mudaraba financing structure, the investor is not allowed, in the management affairs of the enterprise, we have invested in which they participate, they are just an investor - period. Day-to-day and overall management of the company must be left to the entrepreneur.

Differences between Islamic and Western VC funding

While the mudaraba Islamic financing structure does not provide for a form of venture capitalism, it also raises some questions that the West can find venture capital fund is un-relaxed.

A key difference between venture capital investments, which correspond with the Sharia, and which is seen more frequently in the West, the allocation of loss.

Traditionally, venture capital funds invest in businesses with high risk, where there is an above average chance that the businessnot be viable, but where the profit is very high on the head. In most cases, this has focused around the area of technology companies, but today it could apply to other industries such as media and medicine. A recurring theme is "high risk". For example, each of Yahoo!, Did Google, Apple, YouTube, MySpace, at some point or another has received venture capital financing. And for each of these successes, there have been hundred faults!

As the ventureCapital funds in the past to invest a high risk sector firms, over time, venture capital firms have a structure that sets it apart from the investment exit: allows you put (a) with maximum profit, and (b) with minimal losses. As we shall see, under the Islamic sharia, those two become a problem. One of the first debate, looking for all venture capital fund to invest in a company need to do this is how they leave, from the company. All things being theselected as the exit from the venture capital fund will, through an Initial Public Offering (IPO) of shares in the company to the general public. However, in order to choose an IPO as an exit strategy in an Islamic venture capital fund investments have structure, is not allowed. Therefore, an alternative mechanism must be considered.

On the downside, as mentioned above, in the worst case, if the company can not succeed, the entrepreneur (mudarib) does not lose more thanthe time and effort they invested in the company. As such, in fact, the investor bears the brunt of the financial risk in the failure of the company. Thus, traditional procedures, if not, the venture capital fund would limit losses, or otherwise give the venture capital firm the advantage over other investors in the company in a bankruptcy scenario, as the use of a preference share structure which is forbidden under Islamic law.

The second key differencedeal between a Western structure of venture capital financing and an Islamic venture capital financing deal relates to the management of the company itself creates. In almost all cases of venture capital investments in the West, will be the venture capital fund with a team that will bring the business, either directly (hands-on ") or monitored carefully to the direction in which the business is. In fact, so important is this aspect of venture capitalism in the West, that is to say, most consultantsEntrepreneurs, if a venture capital fund is or is not willing to take on this role and should bring on board the experiences they have gained, then they do not choose the venture capital fund as part of the business. Given the limitations mudaraba, many scientists regard this as a forbidden!

Insurance Online

Continuar leyendo

Ocultar articulo

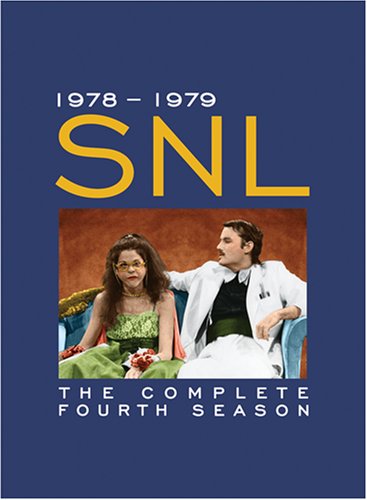

Saturday Night Live: The Complete Fourth Season, 1978-1979

Saturday Night Live: The Complete Fourth Season, 1978-1979